Introduction

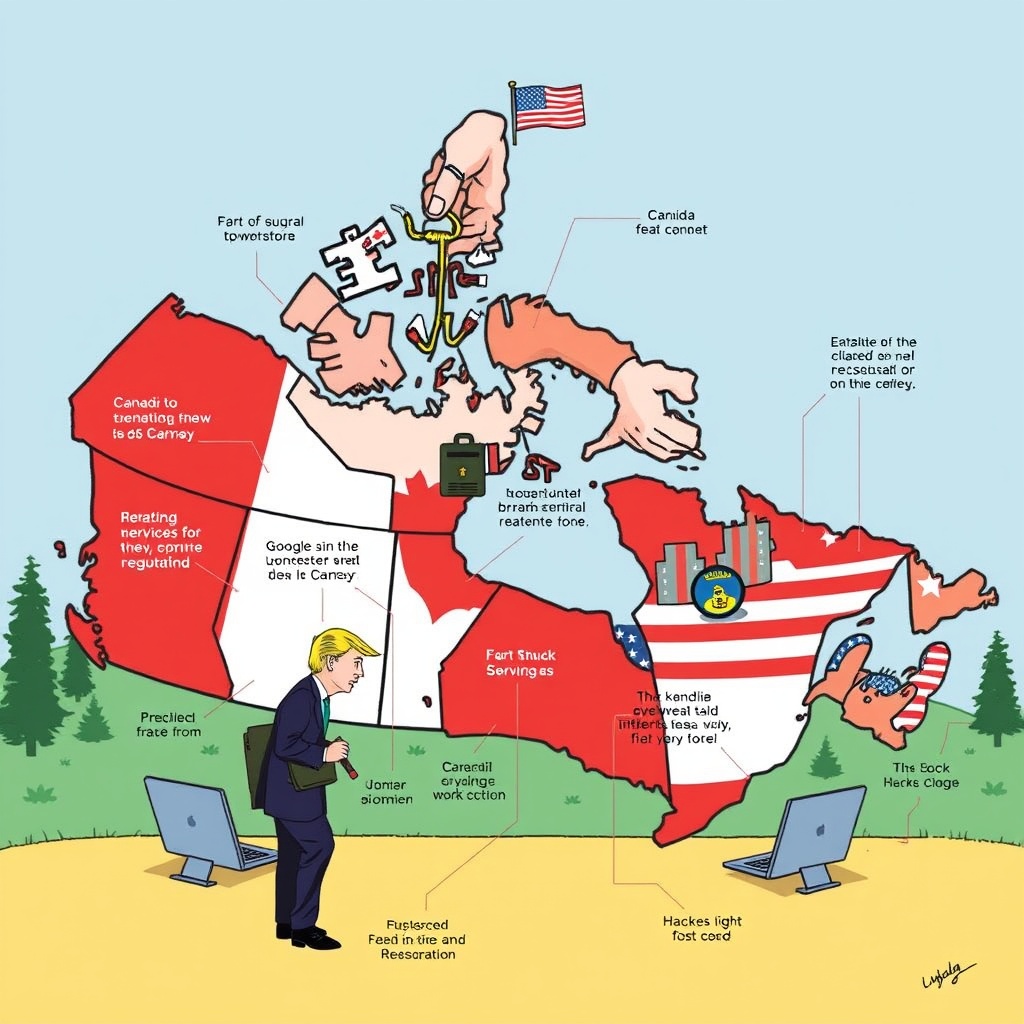

In a significant move to restart trade talks with the United States, Canada has announced its decision to ditch the tax on tech giants, also known as the digital services tax. This development comes after months of negotiations between the two countries, with the aim of reaching a mutually beneficial agreement. The digital services tax, which was initially introduced to target large technology companies such as Google, Facebook, and Amazon, has been a point of contention between Canada and the US. By rescinding this tax, Canada hopes to pave the way for a new trade deal, with a target completion date of July 21. In this article, we will delve into the details of the digital services tax, its impact on trade talks, and the potential implications of Canada's decision to ditch it.

Background on the Digital Services Tax

The digital services tax was introduced by Canada as a way to ensure that large technology companies pay their fair share of taxes. These companies have been criticized for using complex tax avoidance strategies to minimize their tax liabilities, resulting in significant revenue losses for governments around the world. The tax was designed to target companies with annual revenues of over $1 billion, and would have imposed a 3% tax on certain digital services, such as online advertising and social media. The move was seen as a way for Canada to level the playing field and ensure that all companies, regardless of their size or industry, contribute to the country's tax base.

However, the introduction of the digital services tax was met with resistance from the US, which argued that the tax unfairly targeted American companies. The US threatened to impose retaliatory tariffs on Canadian goods, which would have had significant implications for trade between the two countries. The dispute over the digital services tax had become a major obstacle in trade talks between Canada and the US, with both countries unable to reach an agreement.

Impact on Trade Talks

The decision to ditch the digital services tax is seen as a significant concession by Canada, and is expected to restart trade talks with the US. The two countries have agreed to resume negotiations, with the aim of reaching a deal by July 21. The agreement was announced after a meeting between Donald Trump and Mark Carney, the Governor of the Bank of England, who has been involved in the trade talks. The move is seen as a positive development, and is expected to pave the way for a new trade agreement between the two countries.

The implications of Canada's decision to ditch the digital services tax are far-reaching. On the one hand, it is seen as a victory for the US, which had been pushing for the tax to be rescinded. The move is also expected to benefit large technology companies, which will no longer be subject to the tax. However, the decision has been criticized by some, who argue that it will result in significant revenue losses for the Canadian government. Others have also expressed concerns that the move will create a loophole for large companies to avoid paying taxes, which could have negative implications for the country's tax base.

Potential Implications

The decision to ditch the digital services tax has significant implications for trade between Canada and the US. On the one hand, it is expected to improve relations between the two countries, and pave the way for a new trade agreement. The move is also seen as a positive development for large technology companies, which will no longer be subject to the tax. However, the decision has been criticized by some, who argue that it will result in significant revenue losses for the Canadian government.

According to a report by the Canadian Chamber of Commerce, the digital services tax was expected to generate significant revenue for the Canadian government. The report estimated that the tax would have generated over $1 billion in revenue per year, which would have been used to fund public services and infrastructure projects. The decision to ditch the tax means that this revenue will no longer be available, which could have negative implications for the country's public finances.

On the other hand, the move is seen as a significant concession by Canada, and is expected to improve relations between the two countries. The decision to ditch the digital services tax is also seen as a way to level the playing field, and ensure that all companies, regardless of their size or industry, contribute to the country's tax base. According to a statement by the Canadian government, the move is expected to "promote fairness and competitiveness in the digital economy, and ensure that all companies pay their fair share of taxes."

Case Studies and Examples

There are several examples of countries that have implemented digital services taxes, with varying degrees of success. For example, France introduced a digital services tax in 2019, which imposed a 3% tax on certain digital services. The tax was expected to generate significant revenue for the French government, but was met with resistance from the US, which argued that the tax unfairly targeted American companies.

Another example is the UK, which introduced a digital services tax in 2020. The tax imposes a 2% tax on certain digital services, and is expected to generate significant revenue for the UK government. However, the tax has been criticized by some, who argue that it will create a loophole for large companies to avoid paying taxes.

In conclusion, the decision by Canada to ditch the digital services tax is a significant development in trade talks with the US. The move is expected to pave the way for a new trade agreement, and improve relations between the two countries. However, the decision has been criticized by some, who argue that it will result in significant revenue losses for the Canadian government. As the two countries move forward with trade talks, it will be important to monitor the implications of this decision, and ensure that any new trade agreement is fair and beneficial to both countries.

Conclusion

In conclusion, the decision by Canada to ditch the digital services tax is a significant development in trade talks with the US. The move is expected to pave the way for a new trade agreement, and improve relations between the two countries. However, the decision has been criticized by some, who argue that it will result in significant revenue losses for the Canadian government. As the two countries move forward with trade talks, it will be important to monitor the implications of this decision, and ensure that any new trade agreement is fair and beneficial to both countries.

The future of trade between Canada and the US is uncertain, but one thing is clear: the decision to ditch the digital services tax is a significant concession by Canada, and is expected to have far-reaching implications for trade between the two countries. As we look to the future, it will be important to monitor the progress of trade talks, and ensure that any new trade agreement is fair and beneficial to both countries. With the target completion date of July 21 looming, it remains to be seen whether the two countries will be able to reach a mutually beneficial agreement. One thing is certain, however: the decision to ditch the digital services tax is a significant development in trade talks, and will have important implications for the future of trade between Canada and the US.

Leave a comment