Introduction

The stock market experienced a significant downturn on Tuesday, with the Dow Jones Industrial Average plummeting 870 points and the S&P 500 dropping 2% in its worst day since October. This substantial decline was largely attributed to President Donald Trump's intensified rhetoric on Greenland, where he threatened to impose new tariffs on countries that do not support the United States' interests in the region. The threat of tariffs has sent shockwaves through the global economy, raising concerns about the potential for a trade war and its impact on international relations. In this article, we will delve into the details of the market's reaction, the reasoning behind Trump's tariff threat, and the potential consequences for the global economy.

The Market's Reaction to Trump's Tariff Threat

The stock market's response to Trump's tariff threat was swift and severe. The Dow Jones Industrial Average, which is composed of 30 major U.S. companies, fell 870 points, or 3.1%, to close at 27,502.81. The S&P 500, which is a broader index of the U.S. stock market, dropped 2% to 3,116.39, marking its worst day since October. The technology-heavy Nasdaq Composite also suffered significant losses, declining 2.8% to 8,952.87. The market's reaction was not limited to the United States, as international markets also experienced declines. The Stoxx Europe 600 index fell 1.3%, while the Nikkei 225 in Japan dropped 1.1%.

The market's downturn was largely driven by concerns about the potential impact of Trump's tariff threat on global trade. The imposition of tariffs on countries that do not support the United States' interests in Greenland could lead to a trade war, which would have far-reaching consequences for the global economy. A trade war would disrupt supply chains, increase costs for consumers, and potentially lead to a recession. The market's reaction reflects the uncertainty and concern that investors have about the potential consequences of Trump's actions.

The Reasoning Behind Trump's Tariff Threat

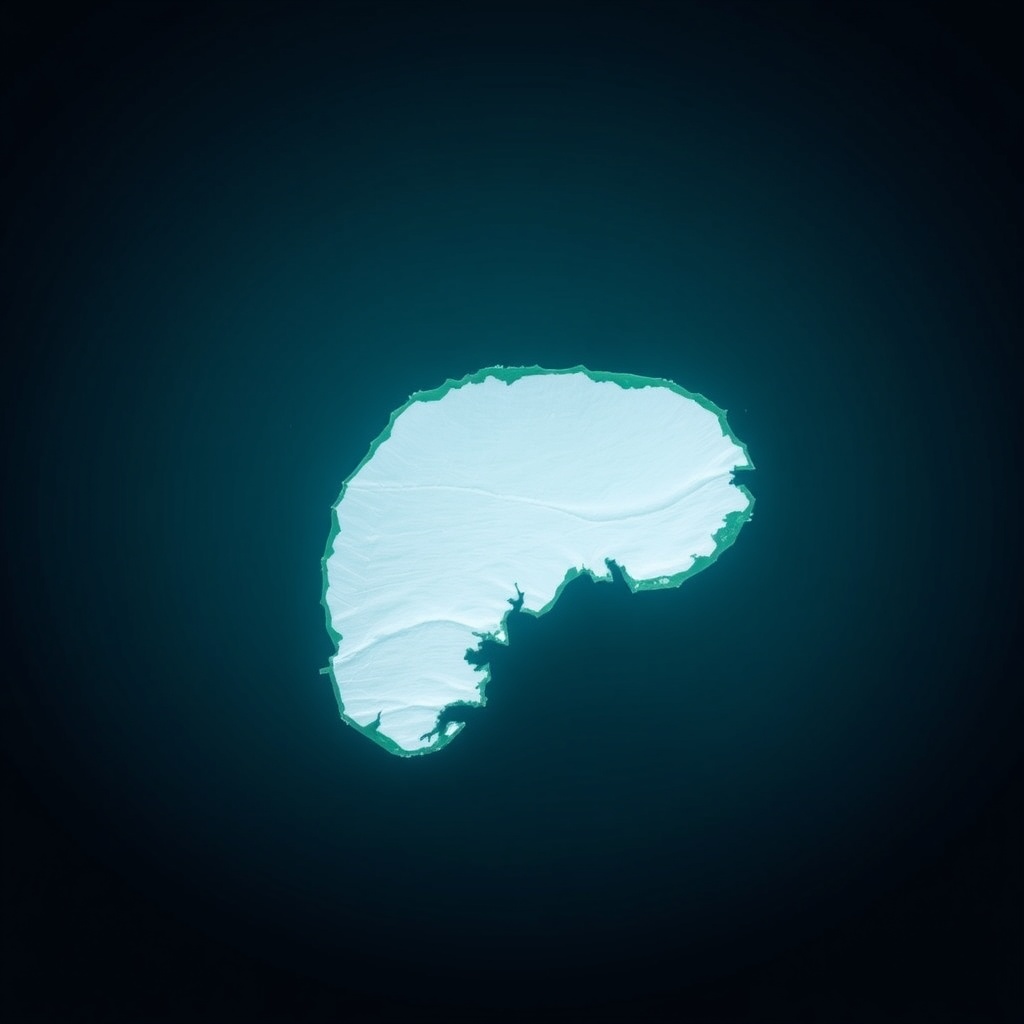

The reasoning behind Trump's tariff threat is rooted in his desire to assert the United States' interests in Greenland. Greenland, which is an autonomous territory within the Kingdom of Denmark, has become a point of contention between the United States and Denmark. Trump has expressed interest in purchasing Greenland, which Denmark has rejected. In response, Trump has threatened to impose tariffs on Denmark and other countries that do not support the United States' interests in the region.

Trump's tariff threat is also motivated by his desire to demonstrate his commitment to protecting American interests. The imposition of tariffs is a key component of Trump's trade policy, which is focused on reducing the U.S. trade deficit and protecting American industries. By threatening to impose tariffs on countries that do not support the United States' interests in Greenland, Trump is sending a message that he is willing to take bold action to protect American interests.

The Potential Consequences of Trump's Tariff Threat

The potential consequences of Trump's tariff threat are significant and far-reaching. The imposition of tariffs on countries that do not support the United States' interests in Greenland could lead to a trade war, which would have devastating consequences for the global economy. A trade war would disrupt supply chains, increase costs for consumers, and potentially lead to a recession.

The consequences of a trade war would be felt across the globe, with countries that are heavily reliant on international trade being particularly vulnerable. The European Union, which is a significant trading partner of the United States, would likely be heavily impacted by a trade war. The EU has already expressed concerns about the potential consequences of Trump's tariff threat, with the European Commission warning that a trade war would have "serious consequences" for the global economy.

In addition to the economic consequences, Trump's tariff threat also has significant geopolitical implications. The imposition of tariffs on countries that do not support the United States' interests in Greenland could damage relationships between the United States and its allies. The NATO alliance, which is a cornerstone of European security, could be put at risk if the United States imposes tariffs on its allies. The consequences of a damaged NATO alliance would be significant, with the potential for a decline in European security and an increase in tensions between the United States and its allies.

Conclusion

In conclusion, the stock market's downturn in response to Trump's tariff threat is a significant concern for investors and policymakers. The potential consequences of a trade war are far-reaching and devastating, with the potential to disrupt supply chains, increase costs for consumers, and lead to a recession. The reasoning behind Trump's tariff threat is rooted in his desire to assert the United States' interests in Greenland, but the consequences of his actions could have significant and long-lasting impacts on the global economy.

As the situation continues to unfold, it is essential for investors and policymakers to remain vigilant and prepared for any potential consequences. The imposition of tariffs on countries that do not support the United States' interests in Greenland could have significant and far-reaching consequences, and it is essential to consider the potential risks and consequences of such actions. By understanding the market's reaction, the reasoning behind Trump's tariff threat, and the potential consequences of his actions, we can better navigate the complex and ever-changing landscape of the global economy.

In the coming days and weeks, it will be essential to monitor the situation closely and to be prepared for any potential developments. The stock market's reaction to Trump's tariff threat is a significant concern, and it is essential to consider the potential consequences of his actions. By staying informed and up-to-date on the latest developments, we can better navigate the complex and ever-changing landscape of the global economy and make informed decisions about our investments and our economic futures.

The potential consequences of Trump's tariff threat are not limited to the stock market. The imposition of tariffs on countries that do not support the United States' interests in Greenland could have significant and far-reaching consequences for the global economy. A trade war would disrupt supply chains, increase costs for consumers, and potentially lead to a recession. The consequences of a trade war would be felt across the globe, with countries that are heavily reliant on international trade being particularly vulnerable.

In addition to the economic consequences, Trump's tariff threat also has significant geopolitical implications. The imposition of tariffs on countries that do not support the United States' interests in Greenland could damage relationships between the United States and its allies. The NATO alliance, which is a cornerstone of European security, could be put at risk if the United States imposes tariffs on its allies. The consequences of a damaged NATO alliance would be significant, with the potential for a decline in European security and an increase in tensions between the United States and its allies.

The situation is complex and multifaceted, with many different factors at play. The stock market's reaction to Trump's tariff threat is just one part of a larger story, with significant implications for the global economy and international relations. As the situation continues to unfold, it will be essential to stay informed and up-to-date on the latest developments, and to consider the potential consequences of Trump's actions. By doing so, we can better navigate the complex and ever-changing landscape of the global economy and make informed decisions about our investments and our economic futures.

In the end, the outcome of the situation is far from certain. The stock market's reaction to Trump's tariff threat is a significant concern, and the potential consequences of his actions are far-reaching and devastating. However, it is also possible that the situation could be resolved through diplomatic means, with the United States and its allies working together to find a solution that benefits all parties involved. Regardless of the outcome, one thing is certain: the situation will continue to be closely watched and monitored, with significant implications for the global economy and international relations.

The key to navigating this complex and ever-changing landscape is to stay informed and up-to-date on the latest developments. By doing so, we can better understand the potential consequences of Trump's actions and make informed decisions about our investments and our economic futures. The situation is complex and multifaceted, with many different factors at play. However, by staying informed and up-to-date, we can better navigate the situation and make informed decisions about our investments and our economic futures.

The potential consequences of Trump's tariff threat are significant and far-reaching, with the potential to disrupt supply chains, increase costs for consumers, and lead to a recession. The consequences of a trade war would be felt across the globe, with countries that are heavily reliant on international trade being particularly vulnerable. The European Union, which is a significant trading partner of the United States, would likely be heavily impacted by a trade war. The EU has already expressed concerns about the potential consequences of Trump's tariff threat, with the European Commission warning that a trade war would have "serious consequences" for the global economy.

In addition to the economic consequences, Trump's tariff threat also has significant geopolitical implications. The imposition of tariffs on countries that do not support the United States' interests in Greenland could damage relationships between the United States and its allies. The NATO alliance, which is a cornerstone of European security, could be put at risk if the United States imposes tariffs on its allies. The consequences of a damaged NATO alliance would be significant, with the potential for a decline in European security and an increase in tensions between the United States and its allies.

The situation is complex and multifaceted, with many different factors at play. The stock market's reaction to Trump's tariff threat is just one part of a larger story, with significant implications for the global economy and international relations. As the situation continues to unfold, it will be essential to stay informed and up-to-date on the latest developments, and to consider the potential consequences of Trump's actions. By doing so, we can better navigate the complex and ever-changing landscape of the global economy and make informed decisions about our investments and our economic futures.

Leave a comment